Buying a home now or waiting for mortgage rates to drop is a huge financial decision that can affect your future. Given the current economy and changing mortgage rates, buying a home now might be a good idea.

The Current Mortgage Landscape

Mortgage rates have been fluctuating because of factors like inflation, Federal Reserve policies, and global market conditions. While higher mortgage rates can mean higher monthly payments, waiting for rates to drop might not be the best strategy for everyone.

Waiting for Rates to Drop: A Double-Edged Sword

A common reason to wait is to get a lower interest rate, which would reduce your monthly mortgage payments. However, this strategy comes with significant risks and challenges:

- Increased Competition: When mortgage rates eventually drop, the market is likely to become fiercely competitive. More buyers will enter the market, driving up demand for homes. This increased competition means homes will go under contract much faster and often for higher prices. This scenario benefits sellers but creates a tough environment for buyers.

- Higher Home Prices: As demand increases, home prices are likely to rise. Higher home prices might cancel out the money you save on lower mortgage rates. In some cases, you might end up paying more in the long run because of inflated home

prices.

The Benefits of Buying Now

Despite higher mortgage rates, there are compelling reasons to consider buying a home now:

Start Building Equity:

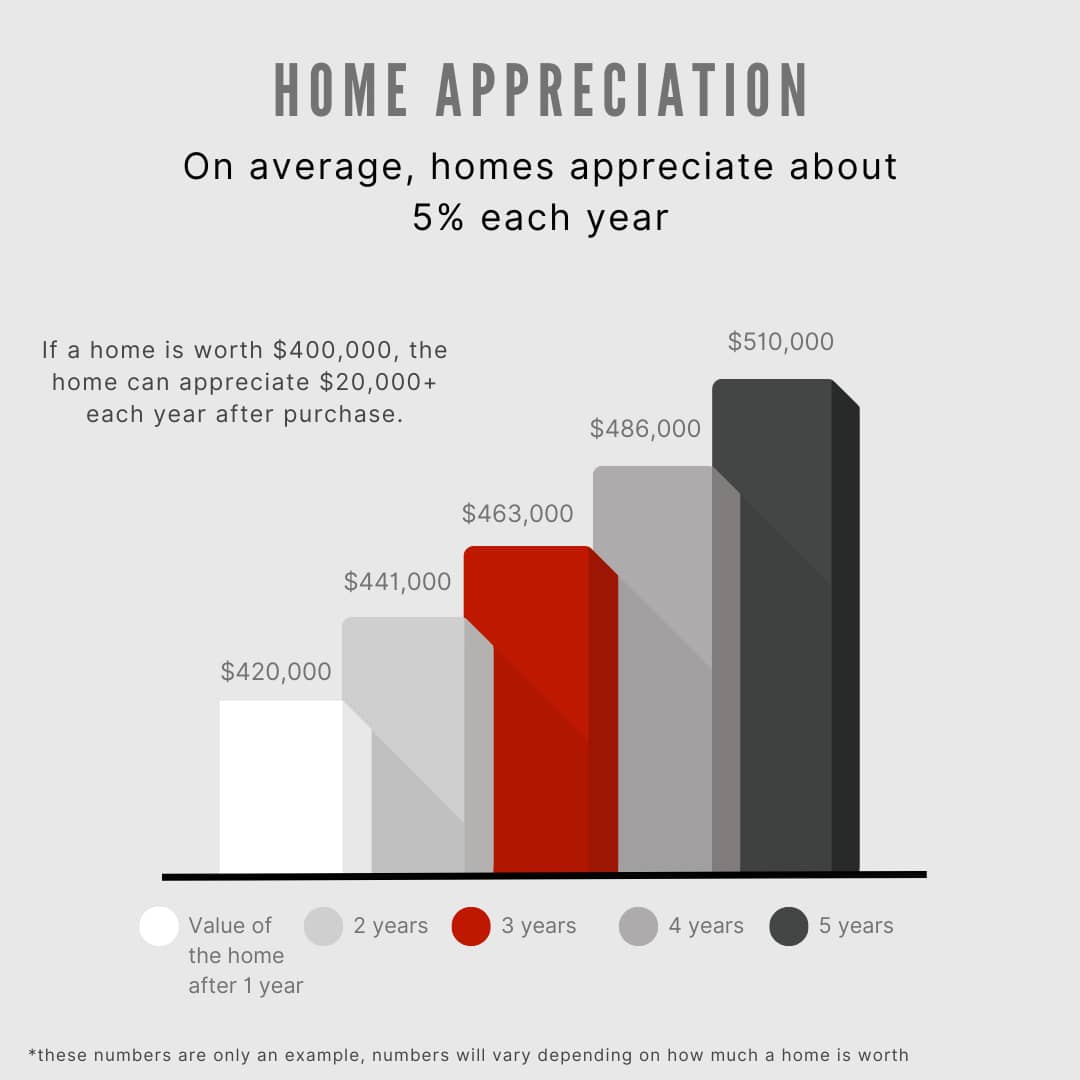

Buying a home offers the chance to build equity, which boosts your financial stability in the long run. Homes typically increase in value by about 5% each year, so buying now means you can benefit from this potential value growth right away.

As your home’s value increases, your equity grows, adding a valuable asset to your wealth portfolio. This equity can also serve as leverage for future goals, such as home improvements or funding other major life goals.

Below is an example illustrating the annual appreciation of a home starting at $400,000. Each year, the home’s value increases by 5%, equivalent to $20,000. Starting from its initial value, the home appreciates to $420,000 by the end of the first year. This visualization demonstrates how steady appreciation can significantly increase the home’s worth over time, highlighting the potential financial benefit of owning property.

Stability:

Owning a home offers a level of stability that renting cannot match. With a fixed-rate mortgage, you have stable monthly payments that shield you from rental price changes. This stability allows for better long-term financial planning and peace of mind.

Plus, owning a home lets you customize your space and make improvements that boost comfort and property value. These investments improve your life and build equity in your home, an asset that grows with your goals.

Tax Benefits:

Homeownership often brings valuable tax advantages that can significantly impact your financial situation. For instance, deductions for mortgage interest and property taxes are common benefits that homeowners enjoy. These deductions have the potential to lower your overall tax liability, thereby making homeownership more financially feasible and attractive.

By using these tax benefits, homeowners can save money and have more disposable income for other expenses or investments. This shows that homeownership is a valuable financial asset that can benefit your long-term financial well-being.

Refinancing Opportunities:

If mortgage rates drop in the future, you can always refinance your mortgage to secure a lower rate. Refinancing can lower your monthly payments and reduce the total interest paid over the life of the loan. By buying now, you position yourself to take advantage of future rate drops without the pressure of a competitive market.

Conclusion

Deciding to buy a home now or wait for lower rates depends on your finances, long-term goals, and risk tolerance. Waiting for lower rates might seem appealing, but it risks facing a competitive market and higher home prices. Buying now allows you to start building equity and benefit from home appreciation.

Ultimately, the best choice depends on your individual circumstances and priorities. Consulting with the top Real Estate Team, such as The Legacy Group, can provide personalized guidance to help you make an informed decision.

Are you ready to start your home buying journey? We have the best real estate agents in the Spokane, WA, Tri-Cities, WA, and Coeur d’Alene, ID areas. Reach out to us today to discuss your Real Estate goals.

For more information, check out our Buyers Guide here: https://thelegacygrouprealestate.com/buyers/deciding-to-buy/

For a FREE home evaluation, sign up here: https://bit.ly/legacyhomeevaluation