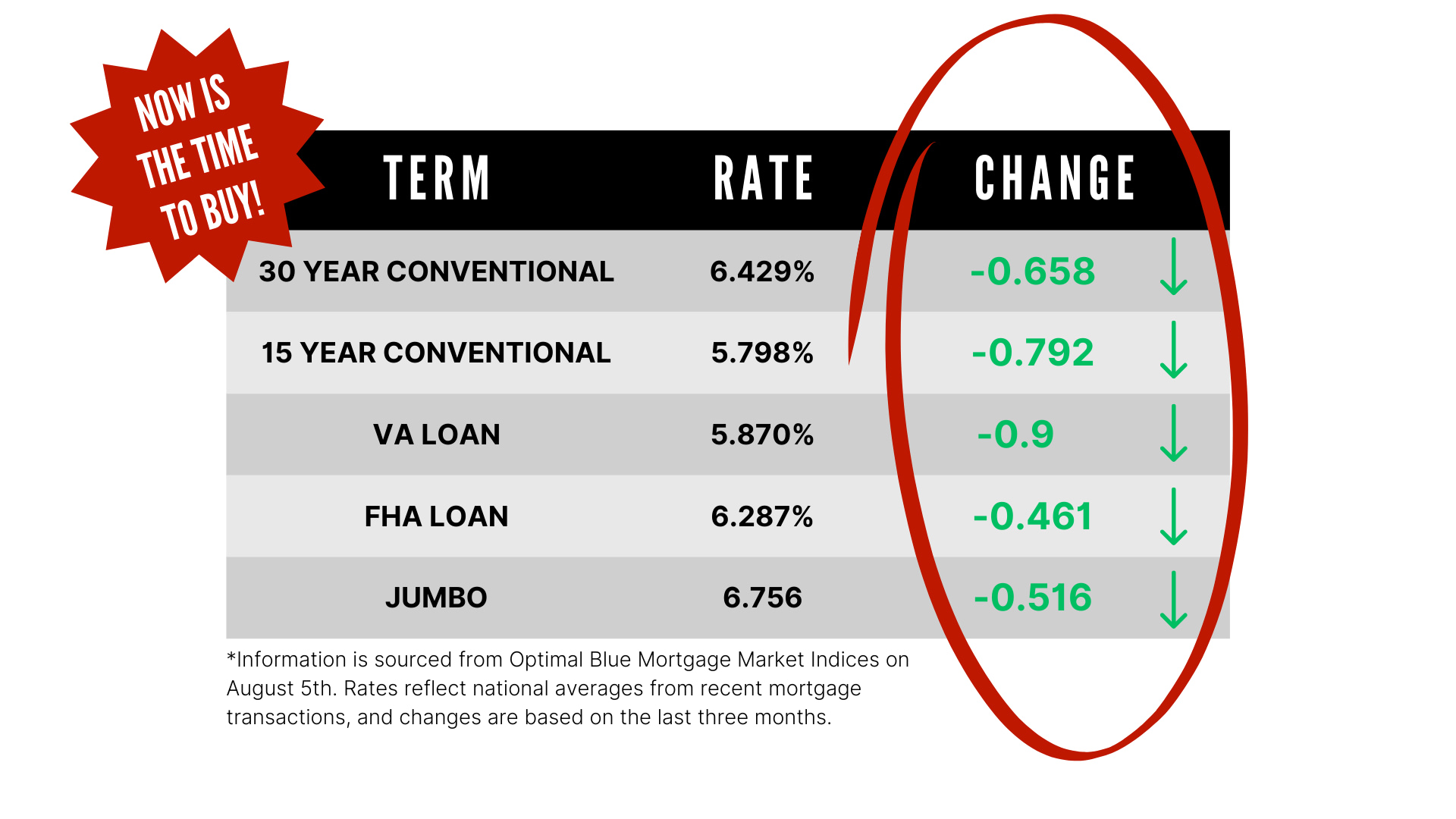

Interest Rates Drop Significantly

The real estate market has been on a wild ride over the past few years. Changing mortgage

rates might have made things uncertain for people buying a home or refinancing their

current mortgage. However, recent news has brought a breath of fresh air to the housing

market: mortgage interest rates have seen a notable drop.

Understanding the Current Rate Drop

Recent economic data and shifts in monetary policy have led to a decrease in mortgage

interest rates. The Federal Reserve’s latest moves have contributed to this favorable trend.

Along with changes in inflation rates and overall economic conditions. For homebuyers,

this drop means more affordable financing options and a potential boost in purchasing

power.

What Does This Mean for Homebuyers?

1. Increased Affordability: Lower interest rates directly impact your monthly

mortgage payments. With rates dropping, you might find that you can afford a

higher-priced home or that your current budget stretches further than before. This

can bring new possibilities in your home search.

2. Greater Savings Over Time: A lower interest rate means you’ll pay less in interest

over the life of your loan. This can lead to significant savings and more financial

flexibility in the long run.

3. Refinancing Opportunities: If you’re already a homeowner, this could be a great

time to refinance your existing mortgage. A lower rate could reduce your monthly

payments or shorten the term of your loan. That can save you money and potentially

allow you to pay off your home sooner.

4. Boosted Market Activity: Lower rates often stimulate the real estate market. More

buyers could enter the market and take advantage of the reduced rates. This means

there may be increased competition for homes, which can drive up property values.

This could be an ideal time for sellers as well, as they might find more interested

buyers.

What Does This Mean for Sellers?

1. Increased Buyer Pool: As mortgage rates decrease, more buyers may enter the market, leading to a larger pool of potential purchasers for your home. This heightened demand can increase the likelihood of receiving multiple offers and potentially getting a higher sale price.

2. Faster Sales: With more buyers actively looking to take advantage of lower rates,

homes may sell more quickly. This can be beneficial if you’re looking to move or sell

your property within a specific timeframe.

3. Higher Home Values: Lower mortgage rates can increase property values. Buyers

are willing to spend more on homes when financing is more affordable. This could

result in a better return on your investment when you sell.

4. Competitive Edge: In a market with reduced interest rates, your property might

stand out more to buyers who are eager to act quickly. Making sure your home is

well-prepared and priced right can make it stand out and attract more buyers in a

busy market.

What to Watch For

Lower rates are good, but it’s important to keep an eye on any economic changes. Rates

could fluctuate based on future economic indicators and policy decisions. That is why it’s

important to work with the Top Real Estate Team in your area, just like The Legacy Group.

They can help you navigate these changes and take advantage of the current market.

Conclusion

The recent drop in mortgage rates is great news for people buying a home or refinancing. It

also brings positive opportunities for sellers by expanding their potential buyer base and

potentially increasing property values. Whether you’re buying, selling, or refinancing, it’s a

great time to explore your options and benefit from the low rates.

Are you ready to start your home buying journey? We have the best real estate agents in the

Spokane, WA, Tri-Cities, WA, and Coeur d’Alene, ID areas. Reach out to us today to discuss

your Real Estate goals.